PEAPACK GLADSTONE FINANCIAL (PGC)·Q4 2025 Earnings Summary

Peapack-Gladstone Posts Record Q4 as NIM Expansion Drives 28% EPS Growth

January 29, 2026 · by Fintool AI Agent

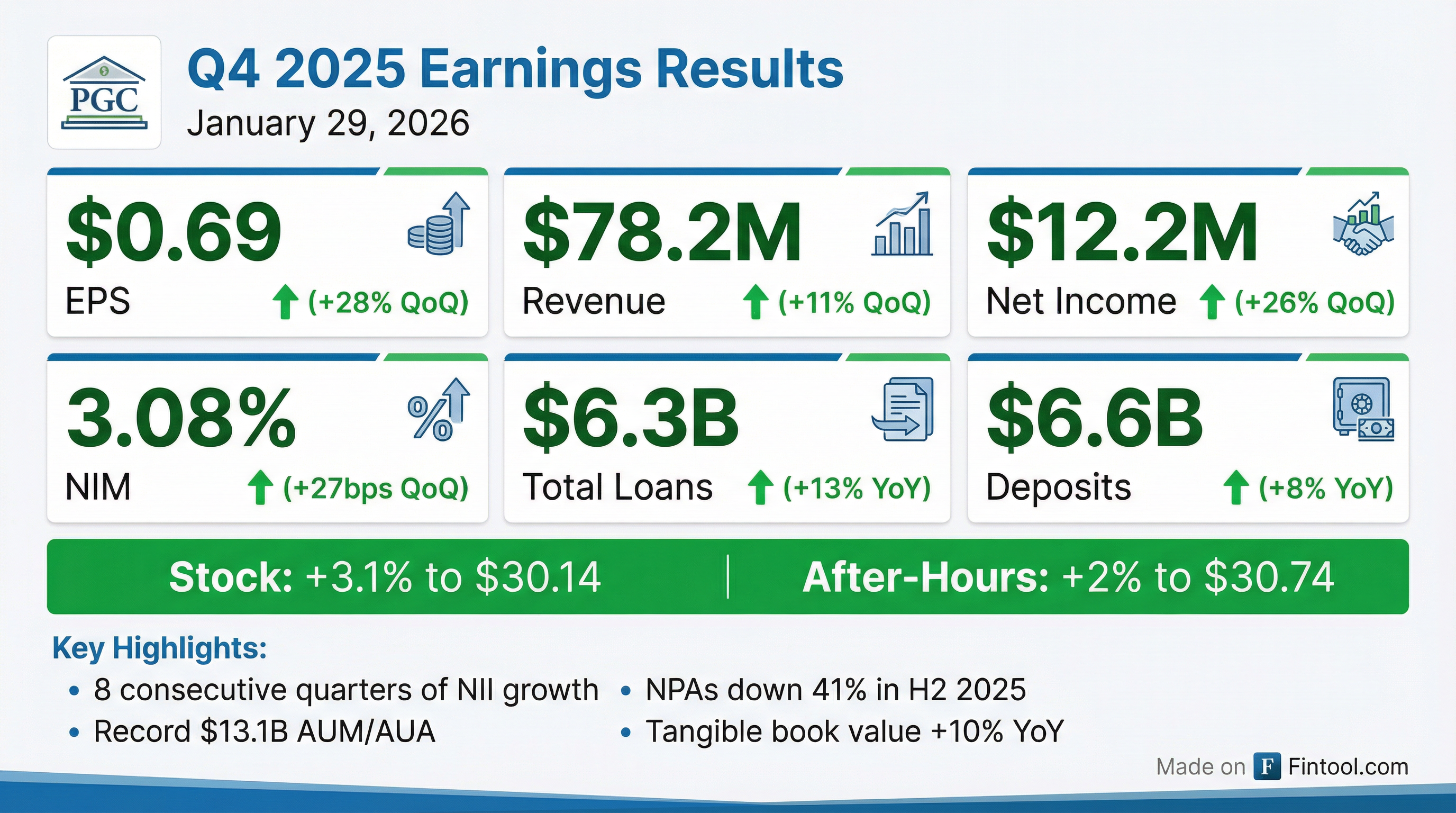

Peapack-Gladstone Financial Corporation (NASDAQ: PGC) delivered its strongest quarterly performance in years, posting diluted EPS of $0.69 for Q4 2025—a 28% jump from the prior quarter and 33% higher than Q4 2024. The New Jersey-based regional bank's results were powered by aggressive margin expansion, as its net interest margin hit 3.08%, up 62 basis points year-over-year. The stock responded favorably, climbing 3.1% to $30.14 during regular trading and adding another 2% after hours.

Did Peapack-Gladstone Beat Earnings?

PGC beat expectations on nearly every metric that matters for a regional bank:

Full year 2025 earnings grew 13% to $37.3M, or $2.10 per share, compared to $33.0M and $1.85 per share in 2024.

The real story isn't just the beat—it's the trajectory. This marks eight consecutive quarters of net interest income growth, driven by the bank's strategic pivot to lower-cost deposits and disciplined loan pricing.

What's Driving the Margin Expansion?

The 62 basis point year-over-year NIM improvement is the headline number, but the mechanics reveal a well-executed deposit strategy:

Key drivers of margin expansion:

-

Deposit beta management: PGC achieved a 92% deposit beta in Q4 2025 and 69% through the Fed's rate-cutting cycle, rapidly repricing deposits lower.

-

Core deposit remix: Core relationship deposits increased $828M (16%) in 2025, with noninterest-bearing deposits up $316M (28%). NIB deposits now represent 22% of total deposits.

-

Loan pricing discipline: New loans were originated at a weighted average coupon of 6.60%, generating incremental spread of more than 400 basis points versus funding costs.

CEO Douglas Kennedy called out the deposit transformation as a key differentiator: "Strong core deposit growth, disciplined pricing, and consistent execution have driven eight consecutive quarters of net interest income growth and continued expansion in our net interest margin."

How Did the Balance Sheet Perform?

Loan growth was concentrated in commercial & industrial lending, which accounted for 55% of Q4 originations and now represents 44% of the total portfolio ($2.7B). Total loans closed in Q4 reached $662M.

Wealth Management continues to anchor the franchise, with AUM/AUA hitting a record $13.1B—up from $11.9B a year ago. New business inflows totaled $291M in Q4 and $1.0B for the full year. Wealth management fee income of $16.1M represented 21% of total revenue.

What Changed From Last Quarter?

Several notable improvements versus Q3 2025:

The efficiency ratio improvement to 68.5% reflects positive operating leverage—the fifth consecutive quarter where revenue growth outpaced expense growth.

How Is Credit Quality Trending?

Credit metrics showed meaningful improvement in Q4:

- Nonperforming assets dropped to $68.2M (0.91% of total assets) from $84.1M (1.13%) in Q3.

- NPAs down 41% over the past two quarters as management aggressively worked out problem credits.

- Past due loans (30-89 days) declined to 0.42% of total loans from 0.48% in Q3.

- Criticized and classified loans decreased $21.6M to $169.9M.

The provision for credit losses was $7.7M in Q4 versus $4.8M in Q3, driven by $5.8M in specific reserves on two multifamily loans and one C&I loan. Management emphasized this reflects proactive workout activity rather than systemic deterioration.

Kennedy noted: "During the fourth quarter, we continued to proactively address problem credits, resulting in a meaningful reduction in nonperforming assets."

New York rent-regulated multifamily exposure—a watched portfolio for metro NY banks—showed no new past-due loans in Q4 and the NYRRMF portfolio has declined $85M (9%) year-over-year.

How Did the Stock React?

PGC shares rose 3.1% to $30.14 on earnings day and added another 2% in after-hours trading to $30.74. The stock is now:

- Up 26% from its 52-week low of $23.96

- Trading at 0.86x tangible book value ($34.99)

- Down 15% from its 52-week high of $35.41

The positive reaction reflects investor approval of the margin expansion story and credit cleanup progress. At current prices, PGC trades at 14x trailing EPS ($2.10) and roughly 11x Q4 annualized earnings ($2.76).

What Did Management Say About the Metro New York Expansion?

PGC's expansion into New York City and Long Island has been a key strategic initiative since 2023. Management provided several updates:

- 925+ new relationships acquired through the Metro NY expansion

- $1.9B in deposits (31% noninterest-bearing) and $1.3B in loans from expansion efforts

- Opened regional flagship offices in NYC, Westchester, and Long Island in 2025

- Rebranded as Peapack Private Bank & Trust to reinforce the high-touch value proposition

Kennedy stated: "We believe Peapack Private Bank & Trust is the premier boutique alternative to the mega banks in metro New York, and the success of our expansion efforts continue to exceed expectations affirming this belief."

Capital Position

PGC maintains strong capital ratios, well above regulatory requirements:

The company declared a $0.05 quarterly dividend payable February 26, 2026. Both Moody's (Baa3/Stable) and Kroll (BBB) rate the company investment grade.

What Are the Key Risks and Concerns?

Management flagged several areas to monitor:

- Operating expense growth expected to continue in 2026 as expansion investments mature

- Interest rate sensitivity remains a factor—continued Fed cuts could compress NIM

- New York rent regulation exposure requires ongoing monitoring, though portfolio is declining

- Credit workout activity will continue as management addresses remaining problem loans

Key Takeaways

- Margin story is working: 8 consecutive quarters of NII growth with NIM at 3.08%—up 62bps YoY

- Deposit franchise transformation: Core deposits up $828M, NIB deposits up 28%, brokered deposits eliminated

- Credit cleanup progressing: NPAs down 41% in H2 2025, no new multifamily problems in Q4

- Metro NY expansion exceeding expectations: 925+ new relationships, $1.9B deposits, $1.3B loans

- Capital and liquidity strong: Well-capitalized ratios, investment grade ratings, $4.6B available liquidity